VIDEO: The National Security Threat of America’s Unprecedented National Debt

The United States has lugged a financial deficit since its founding in 1776 when it borrowed money to provide for the war weight of the American Revolution. However, the national debt is now so high –almost $32 trillion – that it far exceeds the annual economic yield of the whole country, referred to as gross domestic product (GDP).

And while you might hear much about the peril of Russia’s war in Ukraine, climate change or contractable diseases, climbing debt is considered the number one national security threat that could worsen all those problems and cripple the country.

U.S. debt is expected to grow by $19 trillion over the next decade, $3 trillion more than earlier forecasts from the Congressional Budget Office. Even though each political party blames the other, the reality is that this impasse results from both overspending and overborrowing by Republicans and Democrats – and even as alarm bells ring – our elected representatives are making no concrete effort to address the emerging threat.

So, first of all, what exactly is this almost $32 trillion deficit?

This astronomical figure is the amount of money the federal government has borrowed to cover its yearly expenses, using money borrowed by selling salable securities such as Treasury bonds, bills, notes, floating rate notes, and Treasury inflation-protected securities (TIPS). The debt incurred stems from aggregating borrowed funds and the accumulated interest owed to the investors who bought these securities.

In the past, our most significant deficits have stemmed from increased spending during national emergencies, such as major wars or the Great Depression. But in recent times, the debt is the output of policy choices, from legislating trillions in emergency spending, such as the 2008 financial crisis and the 2020 pandemic, to tax cuts and the wars and occupations over the past few decades. Furthermore, revenues from our tax dollars fail to keep pace with the country’s extensive spending programs and Social Security/Medicare benefits for retiring baby boomers. The U.S. healthcare system is considered the most expensive on the planet. We spend more than double on healthcare than most other developed countries, but have little to show for it other than lining the pocket of Big Pharma and K Street lobbyists.

Nevertheless, what tipped the U.S. over the edge in recent years was the 2020 COVID-19 pandemic. In response to widespread decisions to shutter businesses, then-President Trump signed a series of aid packages to the tune of $3 trillion, followed by Biden’s $1.9 trillion stimulus blueprint shortly after taking office, designed to avoid an economic meltdown due to mass quarantines and shutdowns.

Decreased private investment and a weakened hub for manufacturing will further batter our supply chain and propel companies offshore. And if we learned anything from the COVID pandemic, it is that being dependent upon China for vital supplies is a security menace and liability.

A February 2023 Pew Research Center survey shows that public concern over federal spending is on the rise, with 57 percent of those polled perceiving this as a top priority compared to 45 percent a year ago. However, simultaneously, most Americans supported the swollen pandemic relief packages and typically resist cutting down on the most expensive government programs.

But this uneasy direction has steep side effects – and will undoubtedly hurt future generations. Once Washington drains the “extraordinary” mechanisms currently implemented to avoid a debt ceiling crash and runs dry on cash, the government will not be able to pay its bills or even issue new debt. This could lead to a financial crisis of unrivaled proportions.

Such an unnerving scenario of almost defaulting on debt unfolded once before, during the American Revolution, when the Continental Army no longer had the means to buy the weapons needed to continue the war. France came to the U.S.’s rescue with a life-saving hard currency loan, and America’s Founding Fathers have since touted extreme debt as a significant security hazard, highlighting that a slip into the red should only happen during periods of war.

Yet given that today’s leaders cannot show fiscal control, often due to a desire to win elections and appeal to mass voting blocs, the soaring debt prompts investors to insist on sky-high interest rates. This means the Federal Reserve must unload trillions in Treasury securities. The mounting interest cost then depletes the U.S.'s ability to finance critical national security initiatives or responsibly handle a crisis as it emerges. As a result, less money will be available for other things, including infrastructure and medical research, national education and defense spending.

The sprouting of troubles within borders will also require the U.S. to isolate itself from the global stage, no longer able to lead foreign policy planning, benefit people and places in need, and have the necessary relationships and eyes on the ground to avert assaults on the U.S. or U.S. interests. Interest costs will account for half of federal revenue several decades from now. Subsequently, your children, grandchildren and great-grandchildren – perhaps just embarking on their careers and trying to get a foothold in life – will likely be forking out massive taxes for the things that generations before them declined to deal with and chose to irresponsibly kick down the can.

Moreover, our spiraling deficit is a gift to the U.S.’s preeminent nemesis, China. Beijing’s economy is steadily catching up to ours. As the U.S.’s capacity to spend on military strength, intelligence and cyber capabilities diminishes, China’s will only increase. In addition, China is the second largest foreign holder of U.S. debt, second only to Japan. Thus, economists anticipate that by next year, the U.S. will send more than $60 million in taxpayer dollars every day to China – money it can then use to bolster its resources against the United States. Let that absurdity sink in.

Over the last few years, the Chinese yuan has also gained increasing recognition as a reserve currency in light of China’s growing economic influence and efforts to internationalize its currency. Consequently, an American debt default could make the yuan a more attractive alternative to the U.S. dollar for central banks and investors.

And on a personal level, the surging debt affects you too in many ways. Every day, we fork out $965 million in interest. As that number ascends and inflation kicks in, food prices ascend, taxes may go up, and your dollar gets you and your family less and less.

An all-out crisis now is a matter of when, not if. President Biden and the Republican-dominated House of Representatives are on a jarring crash course over increasing the statutory limit on national debt. House Republicans demand the Executive branch concede to major spending cuts in exchange for their agreement to raise the limit and allow the government to continue paying its obligations on time and as per the law.

Nevertheless, spending programs are extremely popular politically. President Biden maintains he will not negotiate over increasing the borrowing cap. The intelligent thing would be for both sides of the aisle to work together to return to some degree of budgetary responsibility. However, one cannot count on that happening anytime soon.

Although it is too soon to determine the full outcome, a potential U.S. debt default could make digital currencies a lifeline for many Americans. With a loss of confidence in the standard U.S. dollars, financial leaders could turn to Bitcoin or decentralized exchanges and stablecoins as a safer reserve option, increasing innovation and demand for cryptocurrencies. On the other hand, the impact on cryptocurrencies could lead to heightened regulation of the largely unregulated digital arena as governments scramble for ways to steady wilting economies.

However, it is also likely that the breadth of the devastation of a U.S. debt default would impact financial markets on every level – from the centralized to the decentralized. And with the bickering in and around Capitol Hill, unless someone steps up, you and I and our offspring will pay a bitter price.

For speaking queries please contact meta@metaspeakers.org

Order your copy of “Afghanistan: The End of the US Footprint and the Rise of the Taliban Rule” due out this fall.

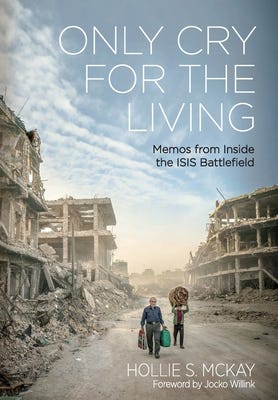

For those interested in learning more about the aftermath of war, please pick up a copy of my book “Only Cry for the Living: Memos from Inside the ISIS Battlefield.”

If you want to support small businesses: